Insurance Explained: Protecting Your Future and Financial Assets

Understanding insurance is essential for anyone seeking to safeguard their monetary future. It acts as a protective barrier against unexpected events that could lead to significant losses. Various types of coverage exist, suited to various individual necessities. However, many individuals struggle figuring out the necessary extent of coverage or understanding the fine print of the agreement. The intricate nature of insurance often lead to confusion, prompting the need for a clearer understanding of how to safeguard assets effectively. What should one consider before committing to a policy?

Insurance 101: What You Need to Know

Insurance functions as a monetary safeguard, protecting individuals and businesses against unexpected dangers. It is essentially an agreement connecting the policyholder and the provider, in which the policyholder remits a fee in exchange for financial coverage covering defined damages or setbacks. The essence of insurance lies in risk management, allowing individuals to transfer the burden of possible monetary damage onto a provider.

Coverage agreements detail the rules and stipulations, detailing what is covered, which situations are not covered, and the procedures for filing claims. The idea of combining funds is key to insurance; numerous people contribute to the scheme, allowing for the funding of claims for individuals who suffer setbacks. Understanding the basic terminology and principles is vital for sound judgment. Overall, insurance is designed to provide peace of mind, guaranteeing that, during emergencies, individuals and businesses can recover and move forward successfully.

Insurance Categories: A Detailed Summary

Many different kinds of insurance exist to cater to the diverse needs of both private and commercial entities. Key examples are medical insurance, designed to handle doctor bills; car coverage, guarding against damage to vehicles; as well as property coverage, securing assets from perils such as theft and fire. Term insurance grants fiscal safety to recipients upon the death of the policyholder, and coverage for disability replaces wages if one becomes unable to work.

For businesses, complete information liability insurance protects against claims of negligence, and asset insurance secures physical holdings. Professional liability coverage, also known as E&O insurance, defends professionals against lawsuits stemming from errors in their work. Additionally, travel insurance offers protection for unanticipated situations while traveling. Every form of coverage is fundamental to managing risks, allowing individuals and businesses to mitigate potential financial losses and maintain stability in uncertain circumstances.

Determining What Insurance You Need: What Level of Protection is Sufficient?

Figuring out the right degree of insurance protection necessitates a careful evaluation of property value and possible dangers. One should review their financial situation and the assets they wish to protect to determine the necessary protection limit. Effective risk assessment strategies are fundamental to making sure that one is not insufficiently covered nor paying extra for needless protection.

Determining Property Value

Assessing the worth of assets is a crucial stage in knowing the required level of protection to achieve adequate insurance coverage. This process involves establishing the price of personal property, property holdings, and financial assets. Those who own homes need to weigh factors such as current market conditions, the cost to rebuild, and loss of value while assessing their real estate. Furthermore, one must appraise physical items, cars and trucks, and potential liability exposures connected to their property. By completing a detailed inventory and assessment, they are able to pinpoint potential gaps in coverage. In addition, this appraisal allows individuals customize their insurance plans to meet specific needs, guaranteeing sufficient coverage from unanticipated incidents. In the end, accurately evaluating asset value establishes the groundwork for smart coverage choices and financial security.

Risk Assessment Strategies

Developing a full knowledge of asset value naturally leads to the subsequent step: evaluating insurance needs. Risk evaluation techniques entail recognizing future dangers and determining the appropriate level of coverage needed to lessen those hazards. The evaluation commences with a comprehensive list of possessions, including homes and land, vehicles, and private possessions, coupled with a review of possible debts. The individual must consider things such as location, daily habits, and dangers unique to their field that could impact their insurance requirements. Furthermore, reviewing existing policies and finding coverage deficiencies is crucial. Through risk quantification and matching them to asset worth, you can make educated choices about the required insurance type and quantity to secure their future reliably.

Understanding Policy Terms: Essential Ideas Clarified

Knowing the policy provisions is crucial for handling the complicated nature of insurance. Key concepts such as types of coverage, premiums, deductibles, policy limits, and limitations play significant roles in judging how well a policy works. A firm knowledge of these terms helps individuals make informed decisions when picking insurance choices.

Coverage Types Explained

Insurance policies come with a variety of coverage types, all created to handle specific risks and needs. Typical categories involve coverage for liability, which guards against lawsuits; property coverage, safeguarding physical assets; and personal injury coverage, which covers harm suffered by others on one’s property. Additionally, extensive coverage offers protection against a wide range of risks, including theft and natural disasters. Specific insurance types, such as professional liability for businesses and medical coverage for people, adjust the security provided. Understanding these types assists clients in selecting appropriate protection based on their specific situations, guaranteeing sufficient security against possible monetary damages. Each form of protection is essential in a extensive insurance strategy, ultimately contributing to fiscal stability and tranquility.

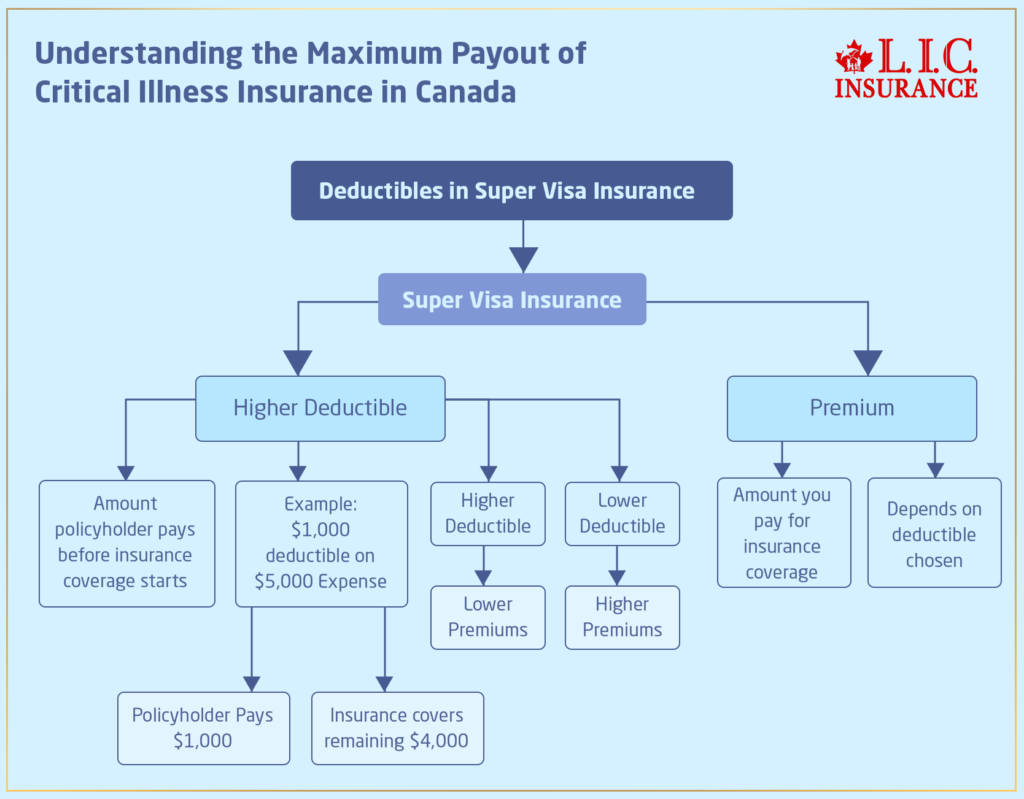

Premiums and Deductibles

Selecting the right coverage types is just one aspect of the insurance puzzle; the financial components of premiums and deductibles also greatly influence policy decisions. The premium is the fee for holding an insurance policy, typically paid monthly or annually. A higher premium often correlates with broader protection or smaller deductible amounts. On the other hand, deductibles are the amounts policyholders must pay out-of-pocket before their coverage begins to apply. Opting for a greater deductible can lower premium costs, but it might cause increased monetary obligation during claims. Recognizing the trade-off between these two components is essential for individuals seeking to secure their holdings while managing their budgets effectively. In the end, the interaction of premiums and deductibles establishes the true worth of an insurance policy.

Exclusions and Limitations

Which factors that can reduce the utility of an insurance policy? Exclusions and limitations within a policy define the circumstances under which coverage is unavailable. Common exclusions include pre-existing conditions, war-related incidents, and certain types of natural disasters. Limitations may also apply to maximum payout figures, making it essential for policyholders to recognize these restrictions thoroughly. These elements can greatly influence payouts, as they dictate what damages or losses will not be paid for. Insured parties need to review their insurance contracts closely to spot these limitations and exclusions, so they are well aware about the scope of their protection. Proper understanding of these terms is crucial for protecting one's wealth and long-term financial stability.

The Claims Process: What to Expect When Filing

Making a claim can often be confusing, particularly for individuals new with the process. The starting point typically involves notifying the insurance company of the incident. This can often be accomplished through a phone call or web interface. After the claim is filed, an adjuster may be assigned to assess the situation. This adjuster will examine the specifics, collect required paperwork, and may even go to the incident site.

After the assessment, the insurer will verify the authenticity of the claim and the amount payable, based on the contract stipulations. Those filing should be prepared to offer supporting evidence, such as photographs or receipts, to facilitate this evaluation. Communication is essential throughout this process; the insured might need to check in with the insurer for updates. A clear grasp of the claims process helps policyholders navigate their responsibilities and rights, ensuring they receive the compensation they deserve in a reasonable timeframe.

Tips for Choosing the Right Insurance Provider

How can someone identify the most suitable insurance provider for their situation? To begin, they need to determine their specific requirements, looking at aspects such as coverage types and spending restrictions. Conducting thorough research is essential; internet testimonials, scores, and customer stories can provide insights into customer satisfaction and the standard of service. In addition, obtaining quotes from multiple providers makes it possible to contrast premiums and coverage specifics.

It is also advisable to evaluate the fiscal soundness and standing of potential insurers, as this can impact their ability to fulfill claims. Talking with insurance professionals can make the terms and conditions of the policy clearer, ensuring transparency. Furthermore, checking for any discounts or bundled services can improve the total benefit. In conclusion, seeking recommendations from trusted friends or family may result in finding reliable options. By adhering to this process, people are able to choose wisely that align with their insurance needs and financial goals.

Staying Informed: Ensuring Your Policy Stays Relevant

After choosing a suitable insurer, policyholders should be attentive about their coverage to ensure it satisfies their shifting necessities. It is crucial to check policy specifics often, as major life events—such as tying the knot, acquiring property, or career shifts—can affect what coverage is needed. Policyholders must plan annual reviews with their insurance agents to review possible modifications based on these changes in circumstances.

Additionally, staying informed about industry trends and shifts in policy rules can provide valuable insights. This knowledge may reveal new insurance possibilities or savings that could improve their coverage.

Monitoring the market for competitive rates may also help find more economical choices without reducing coverage.

Questions People Often Ask

In What Ways Do Insurance Costs Change With Age and Location?

Insurance premiums typically increase with age due to higher risk factors associated with aging people. In addition, geographic area influences costs, as cities usually have steeper rates due to more risk from crashes and stealing compared to non-urban locations.

Am I allowed to alter my current insurer before the policy expires?

Yes, individuals can change their insurer during the policy term, but it is necessary to check the conditions of their current policy and guarantee they have new coverage in place to avoid gaps in protection or possible fines.

What occurs if I fail to make a insurance installment?

Should a person fail to make a premium payment, their insurance coverage may lapse, resulting in a possible lack of coverage. It may be possible to reinstate the policy, but could require back payments and could include fines or higher rates.

Are Pre-Existing Conditions Covered in Health Insurance?

Existing medical issues might be included in health plans, but the extent of protection differs per policy. Numerous providers enforce a waiting time or limitations, whereas some offer instant protection, highlighting the need to check policy specifics carefully.

In what way do deductibles influence My Insurance Costs?

Deductibles affect the price of insurance by setting the sum a covered individual has to pay personally before the plan begins paying. If deductibles are higher, monthly premiums are usually lower, and a smaller deductible causes higher payments and possibly fewer personal costs.